Power2008 Source ArtInfo Just five years ago, it would have been unimaginable that the Indian art scene could go from a provincial backwater to a global powerhouse. But last year, auction and private transactions in the country generated $350 million to $400 million, with the former arena alone netting $110 million, compared with $5 million in 2003. Now groups of eager collectors from the U.S. visit subcontinental artist studios on museum-led tours, and both Serpentine Gallery, in London, and the Mori Art Museum, in Tokyo, are staging major surveys of contemporary Indian art. Among those whose combined efforts have contributed to these remarkable changes are the Delhi-based dealer Peter Nagy, of Nature Morte gallery, and the Mumbai-based dealers and auctioneers Minal and Dinesh Vazirani, of Saffronart.

Comparisons to the Chinese art market, which has also risen as the country’s economy has boomed, are inevitable. Chinese contemporary art may have attracted a flashier following, but Indian art is on the radar of such collectors as Charles Saatchi and François Pinault. Purchases by those heavy hitters ensure that prices will rise even higher for works by marquee names like the painter and sculptor Subodh Gupta, who was recently picked up by the Hauser & Wirth gallery, in London, and Rashid Rana, whose politically charged photo-based works have made him the new darling of the international auction circuit. As it happens, both artists have shown with Nagy for close to 10 years.

The 49-year-old Nagy first opened Nature Morte in New York’s East Village, in 1982. Ten years later, in an act of bohemian wanderlust, he moved to India and quickly established himself as an art critic before reinventing his gallery as an itinerant space and a curatorial experiment in 1997. At the time, he says, “I was finding artists I wanted to work with, and nobody was really showing them in Delhi. So there was an opportunity for me.” By bringing their work to fairs around the world, he has introduced his stable to adventurous collectors avidly seeking new art. Nagy, the first Westerner to open a contemporary gallery in Delhi, inaugurated his current space, in partnership with the Bose Pacia gallery, in 2003.

“He brought a Western perspective to India,” says Veronica Collins, the South Asia contemporary specialist at Phillips de Pury and Company, “and he was one of the pioneers. Peter has an amazing ability to discover art that is inspirational and provocative.” Nagy, who will open a branch of Nature Morte in Berlin next May, is bemused by the remarkable success of his Indian venture, as well as by the rapid ascent of contemporary Indian art. To keep pace, he says, “I’m dancing as fast as I can.”

Nagy’s entrepreneurial spirit is paralleled in the auction world by that of the husband-and-wife team Dinesh, 41, and Minal, 35, Vazirani. Both hold MBAs, he from Harvard and she from INSEAD, in Fontainebleau, France. Aspiring collectors who were frustrated by the lack of information about Indian art, the couple got funding from Sequoia Capital, the Silicon Valley firm that had also put money into Google, to jump-start Saffronart in 2000. Eventually they established brick-and-mortar galleries in New York, Mumbai and, most recently, London. They have also co-organized exhibitions and published scholarly catalogues with other dealers in Los Angeles, San Francisco and Hong Kong. Their partnerships with a network of galleries in India keep their online sales stocked with property.

The Vaziranis have branched out to the much bigger field of jewelry and watches—their debut online sale in the category in early October realized $1.4 million—but the core of their operation is their finely tuned and user-friendly Web portal, www.saffronart.com. “We wanted to have an overall simpler way to get information about Indian artists,” says Minal, “and have a platform that could reach a larger, global audience. That idea became Saffronart.” Their timing was impeccable: The site’s launch coincided with a technology boom in India and the creation of new wealth there.

“In our heart of hearts, we wanted to anticipate that growth and we wanted to use the Internet to reach a great number of people and to make Indian art international,” explains Dinesh. “But we did not anticipate the magnitude of it or the speed of it.”

lundi 1 décembre 2008

Profile: Minal and Dinesh Vazirani+Peter Nagy

mercredi 26 novembre 2008

Indian tycoons feel the pinch from the downturn

Source Herald Tribune These are painful times for Indian tycoons, as indicated by the most recent Forbes Asia Rich List. A falling stock market, a weak rupee and slowing economic growth have shaved about 60 percent off the wealth of the 40 richest people in the nation, Forbes said in its annual compilation earlier this month, with their net worth plunging to $139 billion from $351 billion a year ago.

"They're definitely feeling the pain," said Sonu Bhasin, president of retail finance at Axis Bank and head of the bank's private banking and wealth management divisions, which have nevertheless continued to add new clients in recent months.

"Everyone's hurting, everyone's in a panic, but the wealthy get noticed more and their concerns get addressed."

An economy that grew at about 9 percent in each of the past three years and a six-year bull run on the stock market helped mint new millionaires in one of the largest economies in Asia, a rich class that purchased luxury cars, yachts and sprawling vacation homes.

India had 123,000 millionaires in 2007 and showed the fastest pace of expansion, a Merrill Lynch/Capgemini report said.

But a stock market rout has meant local investors have "notionally lost almost a year's GDP," Credit Suisse said in a recent report titled "Wealth destruction aftermath."

Bhasin's clients, who are high net-worth individuals, are seeking more professional advice and also favoring more traditional investment options, like bank deposits, she said.

"They are seeking safety: Fixed deposits are making a huge comeback, and there is also some interest in gold. We've always told clients making money is a boring exercise. Now they're being more realistic and willing to be bored."

The reality is harsh for the Indian steel baron Lakshmi Mittal, chief of Arcelor Mittal, the world's top steel maker, who gave up his No. 1 position on the Forbes list because of crashing prices. The new No. 1, Mukesh Ambani, chief of the top private Indian company Reliance Industries, has a net worth of about $21 billion, Forbes estimates, down 58 percent from last year.

The loss does not seem to have affected the construction of his $1 billion home on Altamount Road in Mumbai, among the most expensive stretches of residential real estate in the world, even though other luxury apartments in the city are finding few takers.

For homes costing more than 100 million rupees, or $2 million, "demand is very weak because it is linked to big bonuses and stock market returns, which have taken a hit," said Abhisheck Lodha, a director at Lodha Group, a developer in Mumbai.

Real estate tycoons like Kushal Pal Singh of DLF have seen the biggest wealth erosion this year, Forbes noted, while the founders of the windmill maker Suzlon have lost their billionaire status and the liquor baron Vijay Mallya, head of the United Breweries Group, has dropped off the Forbes list because of losses to his Kingfisher airline.

"Business founders were the worst hit as the largest shareholders," said the Credit Suisse report, which estimated that the top 20 business groups in India had lost about 71 percent of the value of their listed investments, or $226 billion, this year.

But while the notional value of their wealth has taken a hit, Indian billionaires still have plenty of loose change for luxury cars, art and wines. Sales of cars priced at more than 2 million rupees have remained strong, bucking the slump in overall Indian car sales.

Car sales fell nearly 7 percent from a year ago in October, but Mercedes-Benz has already met its full-year target, with a 47 percent increase, and sales by Bayerische Motoren Werke, or BMW, have more than doubled.

Neville Tuli, the chairman of Osian's, a leading auction house, is confident that there will be bidders at a coming auction of Indian art and crafts even "in a worst-case scenario." At auctions in New York recently, sales were less than half what they were a year ago and a majority of works were offered at prices far below their presale estimates.

"The Indian economy is stronger than the economies of Europe and the United States, so our art market's stronger," said Tuli, noting there were several new guests at the recent preview. "The art market's really dependent on collectors who, irrespective of what is happening in the rest of the world, will still allocate resources to art. That's their first priority."

As for premium spirits, demand is strong, said Vishal Kadakia, an executive at the importer Wine Park and de facto head of the Bombay Wine Club. "The alcohol industry is probably the most recession-proof," he said. "When times are bad, everyone wants a drink."

Osian’s to auction historical works

Source : Economic Times Top art auctioneer Osian’s is coming up with a sale of the modern and contemporary art and craft of India for the first time. The auction

on 27 November in Mumbai will see a spread of historically significant masterpieces of fine art and a pick of contemporary crafts.

The auction comprises 159 lots which sport a total lower estimate of around Rs 31 crore. The auction’s menu includes iconic works by the Tagores, Amrita Sher-Gil, MF Husain, SH Raza, VS Gaitonde, Sadequain, Ganesh Pyne and Akbar Padamsee among others. The auction is also focusing on artists such as Hemen Mazumdar, GR Santosh, J Sultan Ali, Arun Bose, Nagji Patel, Paresh Maity and Shobha Broota.

With the genre of crafts featuring in the auction, the sale is also unveiling a section on how the folk and craft tradition has inspired the fine arts with works by Jamini Roy, J Sultan Ali, K Laxma Goud, KG Subramanyan, S Nandagopal and PV Janakiram among others.

The auction will also encompass select works from The Camlin Collection such as a rare impasto driven painting by MF Husain, tracing back to 1970 and other works such as Village Scene dated 1974 by NS Bendre and The Pond which was created by Bikash Bhattacharjee in 1995.

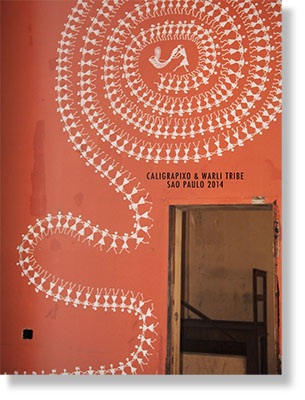

“We are now initiating the process of promoting contemporary crafts with a fine selection of works from the paramparik karigar –– ‘craftsmen’. The range consists of bronze pieces, stone carvings, pattachitra and palm leaf etching from Orissa, gond paintings from Madhya Pradesh, warli paintings from Maharashtra and phad from Rajasthan. In these lots are also mata ni pachedis from Gujarat, West Bengal’s pattas, banarasi and gujarati sarees and kalamkari from Andhra Pradesh.

One of the highlights is pabhuji ka phad, a unique phad painting which was awarded the National Merit Award by the Development Commissioner of Handicrafts in 2006,” Ms Neeti Mallick, vice-president, auction house, Osian’s Connoisseurs of Art, said in an email to ET.

Ms Mallick added, “In the present volatile financial market, high quality fine art probably provides a stable asset which holds and sustains its value with greater consistency than any other financial instruments. The Osian’s collection in our upcoming auction presents high quality artworks for the seasoned and emerging collector. Even in today’s financial situation, there is a great demand for rare and historically significant artworks. We are optimistic that the artworks and crafts will achieve their financial respect.”

lundi 24 novembre 2008

Craft of the Matter

Source : ExpressIndia Georgina Maddox

Thanks to the meltdown, traditional craft finds a place next to modern art at Osian’s auction

Come November 27 and the works of traditional craftsmen will go under the hammer along with paintings of Amrita Sher-Gil and SH Raza. The upcoming Osian’s auction in Mumbai, which is focussing on crafts when art auctions are taking a beating due to the looming recession, will familiarise art lovers with names like Laxmanan, Jaidev Baghel, Moti Karn and Kalyan Joshi of the Paramparik Karigar.

“This auction will be a step towards promoting the traditions of India and creating a conducive environment for craftsmen. In times of recession, it helps to diversify one’s portfolio,” says Neville Tuli, chairman of Osian’s Connoisseurs of Art. It will be a step forward for Paramparik Karigar, a well-known organisation formed by craftsmen to promote the traditional crafts of India. There will be a selection of its works, including bronze pieces, stone carvings, Patachitra and palm-leaf etchings from Orissa, Gond paintings from Madhya Pradesh, Warli paintings from Maharashtra, Phad from Rajasthan and Patuas from Bengal. One of the Phad paintings bagged the National Merit Award by the Development Commissioner of Handicrafts in 2006.

Osian’s has also dedicated a section to fine arts that have been inspired by folk and craft traditions, by including works of Jamini Roy, J Sultan Ali, K Laxma Goud, K G Subramanyan, S Nandagopal and PV Janakiram. The auction comprises 159 lots and is valued, at a low estimate, at around Rs 31 crore. It also includes rare works by Rabindranath Tagore, MF Husain, VS Gaitonde, Sadequain, Ganesh Pyne and Akbar Padamsee. As part of the fine arts section, select works from The Camlin Collection, such as a rare impasto-driven painting by Husain, dated 1970, and other works such as Village Scene (1974) by N S Bendre and The Pond (1995) by Bikash Bhattacharjee have been included. “Even in today’s financial situation, there is always demand for rare and historically significant works,” says Neeti Mallick, vice-president, Auction House of Osian’s.

samedi 15 novembre 2008

The remarkable renaissance in Chinese art

More than half of the world's best-selling painters and sculptors today are from Asia – a major shift after 500 years of domination by Western art. Andrew Johnson reports. Source : The Independent

With its £2 trillion surplus, China's economic might dominates the world. Now its painters and sculptors are developing, collectively, into a contemporary arts superpower. Asian artists, and in particular those from China, dominate a new list of the world's best-selling contemporary artists of last year. Among the world's most sought-after artists are the unfamiliar names of Zhang Xiaogang, Yue Minjun and Zeng Fanzhi.

Of the world's 20 top-selling artists, 13 are from Asia, with 11 coming from China. Asian artists make up six of the top 10 biggest sellers at auction, five of which are Chinese. Experts predict that within a decade, the term "Asian art" will be as widely used as "Western art" and will be responsible for most global sales.

The annual survey of the global art market by the auction tracking site Artprice and the Axa insurance company lists the 500 top-selling artists at 2,900 auctions between July 2007 and June 2008. While the top four selling contemporary artists at auction were the Western superstars Jeff Koons, Jean-Michel Basquiat, Damien Hirst and Richard Prince, almost all the rest are Asian. Other Chinese artists in the top 10 include Wang Guangyi and Yan Pei-Ming. Japan's Takashi Murakami comes in at number eight, while the Indian-born Anish Kapoor, who lives in England, is number 18. It is a seismic shift in an art market dominated by the Western tradition for almost 500 years.

"The total auction revenue generated by 100 Chinese artists in 2003-4 amounted to £860,000," the report says. "The same 100 generated total revenue of £270m over the last 12 months. Of these 100, three are striking for having each generated more than £26m."

Vinci Chang, head of sales at Christie's Asian contemporary department in Hong Kong, said: "These artists grew up in a post-Mao China and have seen a country under decades of turmoil and political and social change. All this has informed their work."

Such is the interest in Chinese art that Charles Saatchi has opened his new gallery in Chelsea with an exhibition of new Chinese talent. Originally, he said, he found Chinese art as very "kitschy" and "derivative". "But there's enough stuff to put on a good show," he said in 2006. "My rule is: if you can put this in the Whitney Biennial and nobody is going to say, 'Oh, that's very good for a Chinese artist,' then that will be fine."

World's 20 top selling artists

1 Jeff Koons, born 1955 in Pennsylvania, incorporates kitsch imagery. Sold £69.4m in the past year.

2 Jean-Michel Basquiat, born 1960 in Brooklyn, New York, was a graffiti artist who died in 1988. Sold £54.3m.

3 Damien Hirst, born 1965 in Bristol, a key member of the Young British Artists. Sold £45.7m.

4 Richard Prince, born 1949 in Panama, is an American painter and photographer. Sold £33m.

5 Zhang Xiaogang, born in 1958 in China's Yunnan province. Sold £32.3m.

6 Zeng Fanzhi, born in 1964 in Wuhan, holds the auction record for a contemporary Asian artist. Sold £27.8m.

7 Yue Minjun, born 1962 in Heilongjiang. Sold £27.8m.

8 Takashi Murakami, born 1962, Tokyo, Japan. Possibly the best known Eastern artist on the list. Sold £15.5m.

9 Wang Guangyi, born 1957, in Heilongjiang. Sold £11.7m

10 Liu Xiaodong, born 1963, Liaoning. Painter and photographer documented the controversial Three Gorges Dam project. Sold £10.5m.

11 Cai Guo-Qiang, born 1957. Performance artist who uses gunpowder to produce 'explosive events'. Sold £10.1m.

12 Yan Pei-Ming, born 1960, Shanghai. Best known for epic portraits of Mao Zedong and Bruce Lee. Sold £9.9m.

13 Chen Yifei, born 1946 in Zhejing. Among the first to break into Western art market. Died in 2005. Sold £9.7m.

14 Fang Lijun, born 1963, Hebei. Painter of the 'cynical realism' school. Sold £9.6m

15 Liu Ye, born 1964, veteran of the post-1989 avant-garde movement. Sold £8.8m.

17 Zhou Chunya, born 1955, Sichuan. Renowned for green portraits. Sold £8.3m.

18 Anish Kapoor, born 1954, in Mumbai, India. Turner Prize-winning sculptor who has lived in England since 1972. Sold £6.7m

19 Peter Doig, born 1959. The Scottish artist's paintings are among Europe's most expensive. Sold £6.7m.

20 Rudolf Stingel, born 1956, in Merano, Italy. Sold £6.5m.

samedi 8 novembre 2008

Bottom falls out of the art market as Manet and Rothko fail to sell

Auctioneers feel the chill as sluggish sales and lower prices signal end of a boom

By Arifa Akbar, Arts Correspondent. Source : The Independt

For so long, the booming art market had appeared impervious to the dipping fortunes of the global economy. But experts now fear the bubble may finally have burst after museum quality paintings by Mark Rothko and Edouard Manet failed to sell at auction. Major sales by Sotheby's and Christie's in New York achieved totals that were millions of dollars below even their lowest estimated prices this week.

On Wednesday night, a post-war and contemporary art sale at Christie's sold half of all the 58 lots at below their expected price, with 30 per cent failing to sell at all. The overall total for the sale was $47m (£38m), well below its estimate of between $100m to $150m.

No43 (Mauve), a painting by Rothko, whose work has set and broken auction records in recent years, failed to sell for between $20m and $30, while multimillion-dollar paintings by Manet did not attract any buyers.

The auction house was last night waiting to see if results of its Impressionist and Modern Art sales would come close to the $240m to $340m estimated total. Marc Porter, Christie's president, reportedly blamed the "difficult economic climate" for the poor results.

A spokesman offered some reassurance, saying: "People are more considered about what they are going to bid for. There is a difference to the art market but at the same time, considering the scale of what's been happening in the financial sector, we are still seeing significant amounts of money changing hands and plenty of liquidity and committed bidding."

Some in the industry suggested the disappointing sales signalled a downturn in the market after a decade of rising prices, and others questioned how much it might plunge.

A Sotheby's sale on Monday night failed to reach its low estimate of $339m, securing only $223m, with a total of 25 works out of 70 remaining unsold including paintings by Monet, Matisse and Cezanne.

A Sotheby's statement said the result was not unexpected in the light of the receding economy but that people were still buying. "This was the first true test of our market in this new environment, and what we saw is that the market is clearly alive," it said. "[The] sale was assembled over the summer and by the time the catalogue came out we were living in a completely different world."

The auction house said bidding among American buyers had remained strong. Three works had bucked the depressing trend, selling for more than $30m, each establishing a record for the artist at auction: Kazimir Malevich's Suprematist Composition sold for $60m, the highest for a Russian work of art at auction, Edvard Munch's Vampire achieved $38m and the Edgar Degas Danseuse Au Repos sold for $37m, also a record for any work on paper ever sold at auction.

The Art Newspaper reported that auction houses were reducing guarantees and lowering reserve prices in the aftermath of weak sales in London and Hong Kong last month. The Wall Street analyst, George Sutton, has predicted entry into "what could be a challenging year for the auction market".

Ian Peck, the chief executive of the art finance firm, Art Capital Group, said the auction results at Sotheby's had been a wake-up call to the art world which "firmly demonstrated that the concept of a recession in the art market is not abstract but real. Prices in all categories – the trophies, the great, and the merely good – were less contested, if at all, and end prices were likely reduced by 20 to 40 per cent".

But Charles Dupplin, from Hiscox art insurers, said it was important to assess the market's financial health after the week-long auctions in New York as well as the Art Basel Miami Beach art fair in December, a major commercial event in the art industry's calender. "It's clearly very tempting to leap to an instant conclusion and there clearly has been a shift in appetite in the market but whether this is realised in prices coming down or not is the real question," he said.

Art and recession: A brief history

The fortunes of the art market tend, as one might expect, to follow those of the economy. After the heady days of the 1980s, the price of art plunged in the early Nineties. However, it was a very different market from today, with collectors from America, Europe and Japan buying largely with borrowed money. When the Japanese economy faltered, so did the art market. It remained in the doldrums for much of the Nineties, after which it began slowly to rise. A tiny dip in 2000 was followed by a further rise, with some parts of the market, such as contemporary and Russian art, growing quicker than others.

Buyers in the Eighties and Nineties formed a narrow collecting pool. Today, there is a much more global group due to modern communication and online bidding. The growth of economies in India and China might soften any impending crash.

mercredi 5 novembre 2008

United colours for Bihar

Source : Times of India

MUMBAI: The victims of the flood in Bihar in August have found good Samaritans in 31 artists from across the country. From Atul and Anju Dodiya and

Jitish Kallat to T V Santhosh and Mithu Sen, artists have donated one work each to an auction organised by Saffron Art, artist couple Subodh Gupta and Bharti Kher, Delhi gallery Nature Morte and the Trident in Gurgaon. Hundred per cent of the proceeds will go to NGOs that work with victims of the flood, said Saffron Art owner Dinesh Vazirani. The works will be auctioned on November 11 and 12 and those interested can visit www.saffronart.com.

The event has been put together in a lightning 20 days. Kher said that she and Gupta urgently called their friends as the condition of the flood victims is quite grim and getting worse. Stories about the global economic meltdown have eclipsed press coverage of flood relief, Vazirani pointed out. Now they have absolutely nothing, said Kher. Its the right time to do an auction. Riyas Komu, one of the contributors, added that Kher and Gupta are doing a worthy thing and that its high time the government tackles natural calamities better. It was an anticipated flood and there had been several warnings.

The even is especially significant for Gupta as he is a native of Bihar. Initially Gupta and Kher had the mad idea that they would go to Bihar themselves to see how they could help. Gupta joked that if he had carried out his plan, he wouldnt have been able to work for at least a year. Two NGOs Goonj and Samajik Shaikshanik Vikas Kendrawill disburse the funds generated by the auction. Vazirani said that a conservative estimate of the target he thinks the auction will achieve is Rs three crore. The upper estimate, he added, is Rs four crore.

The works on display are quite stunning. Bose Krishnamachari, for instance, has served up a psychadelic piece of art titled Stretched Bodies. Delhi-based duo Thukral and Tagra have offered Somnium Genero, a triptych that involves pop art colours, old-fashioned frames and a toaster. In Bharti Khers work, This Way and Never Another Way, tributaries of red, blue, black and white bindis form what looks like a mighty river. The artists have really given great works, Vazirani said. And theyre well-priced. Are the organisers worried that collectors might shy away from spending on art at a time when the global economy is in a deep trough? Gupta explains that he doesnt expect buyers to be chary as theyre not donating money. Even though theyre spending considerable amounts, theyre getting something highly valuable in return, he said. The artists, on the other hand, have donated their paintings without asking for a penny. This is a coming together of artists from India, said Vaziranis wife Minal. Theres a sense of a community. Were able to contribute to the survival of people.

lundi 20 octobre 2008

Art markets decline after financial crash

Source : The Economic Times KOLKATA by Ashoke Nag: There’s little doubt that the global financial meltdown has dented the art market to a degree. Historical data suggest that art markets declMore Pictures

ine 6-12 months after a financial crash. However, in the present debacle, the reaction seems to have been quicker.

The downswing in the art scene, however, has also extended opportunities to the avid collector to lap up quality works of modernist masters and heritage artists from, for instance, the Bengal School of Art at prices lower than the highs achieved during the boom time.

Mr Nirmalya Kumar, a top UK-based art collector and professor of marketing at the London Business School, told ET: “The September 2008 auctions by Sotheby’s and Christie’s in New York did not fare too badly. But, the recent auction of Indian and Islamic art in London clearly indicates that the crisis is taking its toll. Not only were a number of lots left unsold, many of them either fell short of the minimum estimate or just touched the minimum level. I managed to pick up a beautiful Francis Newton Souza for just £5,000. From an investment angle, one should definitely avoid acquiring contemporary artists, who have ascended dramatically over the past 24 months. There’s every possibility that their prices could fall in the next six months.”

The positive side of all this, Mr Kumar said, is that the top-quality works of modern masters, such as Souza, Husain and Raza, will retain their value. At the same time, heritage artists, including those from the Bengal School like Rabindranath Tagore, Jamini Roy and Nandalal Bose, should maintain their value because they have risen steadily and their supply is limited.

“The second quality works of the modernists, however, have seen a decline.” “You can cherry pick, but one shouldn’t buy with the thought that prices will rise significantly in the short run. One should buy what is likable and look at a longer holding period. It’s difficult to predict the direction that the March 2009 auctions of Sotheby’s and Christie’s will take. They are six months away. I’ll be surprised if there is sizable price rise,” Mr Kumar added.

“The NRI fraternity abroad was largely buying Indian art for investment. Only a few, probably, harbour the collector’s psyche. These collectors may take the opportunity to buy works at these depressed prices,” Mr Prakash Kejariwal, collector, art specialist and director of Chitrakoot, Kolkata’s oldest art gallery, said.

“Back in India, those who were investing their surplus share market funds in art will discontinue this pursuit for the time being. There are only a few collectors who don’t depend on the stock market to buy art. But this community is limited. So, the market is bound to shrink and prices could plateau.”

Mr Kejariwal also underscored that quality works of progressives and modernists like Ganesh Pyne, Bikash Bhattacharjee, Somnath Hore, Jogen Chowdhury and Rameshwar Broota are definite buys. In tandem are the old masters like Raja Ravi Verma. Buyers could also go for sculptures, which still enjoy price elasticity. “We must understand that art prices don’t collapse like share tags do. Art is not quoted in the markets as shares are,” Mr Kejariwal said.

Vikram Bachhawat, a well-known gallerist who heads Aakriti Art Gallery and is also the director of Emami Chisel Art, said he has been interacting wiMore Pictures

th people in Mumbai and Delhi and most collectors have shown an interest in sourcing art.

“But, investors want to wait and watch. Some new investors are viewing art as an alternate avenue. At the moment, investors are focusing on auction-listed artists, who number around 300. At the same time, average artists will be glossed over in this market. If fund houses start ploughing money into art, the market, pegged at Rs 1,500-2,000 crore now, will expand at least three-fold.”

“The art market has been under pressure for the past eight to nine months, even before the stock markets crashed. Art works, both high and medium value, have slipped by 25-30%. Someone with liquidity can easily go for high quality modernist works with a long-term perspective. These pieces are available now at 35-40% below the market price a year ago. It’s the right time to buy if one chances upon a good piece. One should look at a timeframe of three to five years while making such an acquisition, though,” Abhijit Lath, collector and director at Akar Prakar Gallery, said.

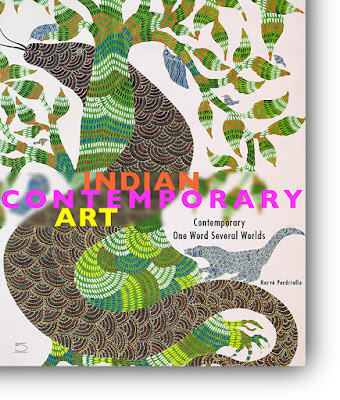

Herve Perdriolle, Indian art consultant at leading French auction house Artcurial, hinted at some optimism: “Many factors should make the Indian market, particularly in these depressed stock market times, a favourite destination for investors and collectors. The Indian market is only about 0.1% of the international market. Compared with 45% of the market share held by the Americans, we can easily imagine a high-growth margin for the Indian art market.”

jeudi 16 octobre 2008

Pas de panique

Le marché à la veille de la Fiac. Source : Challenges

En dépit du sombre état de la finance mondiale, le marché de l'art se porte plutôt bien. Russes et Indiens ont remplacé les collectionneurs américains.

Alors que la 35e édition de la Fiac (lire ci-contre) s'apprête à ouvrir ses portes à Paris, les acteurs du marché de l'art ne peuvent évidemment rester indifférents à la tornade qui secoue l'ensemble des marchés financiers. Pessimistes ? Le mot ne convient pas dans ce milieu feutré où l'on veut toujours croire, sinon au miracle, en tout cas à la spécifi cité d'un marché qui mêle passion et argent. Et de citer, pour commencer, un exemple rassurant : les 15 et 16 septembre, à Londres, la vente organisée par Sotheby's réunissant plus de 200 oeuvres de Damien Hirst a fait un véritable malheur.

Les 118 lots (sur 223) ayant trouvé preneur ont réalisé un produit total de plus de 140 millions d'euros. Détails d'importance : pour la première fois, c'est l'artiste qui proposait à la vente ses propres oeuvres, et non la galerie. Plus étonnant : la vente a eu lieu alors que Wall Street et les Bourses européennes entamaient leur descente aux enfers. Quelle conclusion tirer de cet incroyable succès ? Pour Guillaume Cerutti, PDG de Sotheby's France, cet épisode est significatif de «la grande vitalité du marché de l'art». Car si les acheteurs américains ont été absents de cette vente, le relais a été pris par des collectionneurs européens - Russes, entre autres - et asiatiques - Indiens notamment. De toute manière, ajoute Guillaume Cerutti, «la crise des subprimes ne date pas d'hier, puisqu'elle remonte au coeur de l'été 2007. A l'heure actuelle, celle-ci n'a eu aucune incidence sur notre activité. Pour la France, le montant de nos ventes pour le premier semestre 2008 est en progression de 104% par rapport à la même période de l'année 2007». Les prévisions sont-elles aussi optimistes ? «Notre horizon, commente prudemment Guillaume Cerutti, va d'une vente à l'autre.»

Un point de vue largement partagé par Francis Briest. Le vice- président d'Artcurial reconnaît qu'il «risque de se produire des turbulences. D'expérience, nous savons que dans les périodes difficiles, les acheteurs occasionnels sont moins présents». Et d'ajouter que si certains gros acheteurs risquent de se montrer plus raisonnables, «les piliers seront toujours là». Il n'empêche, les piliers risquent de ne plus être les mêmes. Les regards se tournent désormais vers ceux que l'on appelle encore les «pays émergents» - pays du Golfe, Inde, Chine, Russie et républiques de l'ancien bloc soviétique. Ce n'est pas un hasard si, dans le cadre de la préparation de la vente Damien Hirst, un certain nombre de ses oeuvres ont été exposées plusieurs jours durant en Inde...

Pas de panique donc sur le marché de l'art. Mais une vigilance renforcée. On sera par conséquent très attentif aux ventes organisées à Paris par Artcurial durant la Fiac - ventes d'une collection de dessins et vente d'art moderne les 23 et 24, vente d'art contemporain les 27 et 28 octobre. Entre des oeuvres de Bonnard, Van Dongen, Matisse (pour un très beau fusain sur papier de 1938, Femme nue allongée, estimé entre 300 000 et 400 000 euros), on trouvera même une oeuvre signée Damien Hirst : cette encre de chine sur papier intitulée Cradle to the Grave est estimée entre 3 000 et 4 000 euros. Pas de folie ici, donc. Paris est une ville sage.

samedi 11 octobre 2008

Financial firms cash in on art boom

Madhumita Mookerji / Source : DNA MONEY

Kolkata: The canvas is significant though not particularly large at present. But, especially at a time when stock prices across the world are falling sharply, many strongly feel art is not just for art’s sake but a sound alternate investment option.

Several players — Edelweiss Securities, Bajaj Capital Art House (BCAH) and Art Vibes — are homing in on this potential by offering what is being regarded as art advisory services and portfolio management.

Edelweiss Securities, for instance, introduced an art fund through Yatra Funds and since January 2008, has tied up with Copal Arts to design portfolios in which art lovers and collectors can acquire quality works of artists.

Similarly, Bajaj Capital Art House, launched in August, offers art investment advisory, evaluation of art pieces, authentication certificates, fine art insurance, art restoration and art resale services.

Art Vibes has a strategy to provide portfolio management services for the private and corporate collector. “A wide variety of opportunities would include art collection advisory, valuation and appraisal, documentation and storage, auction representation, cataloguing, restoration and conservation, education and outreach programmes and sponsorships,” said Aashu Maheshwari, head of Art Vibes.

BCAH also provides services in branding requirement of visual artists through promotions, branding and representations etc.

Anurag Mehrotra, head of wealth management, Edelweiss Securities, said, “The Indian art market, though at a very nascent stage, finds connoisseurs worldwide and the numbers are increasing. The valuations are fairly low compared with international art pieces. In terms of market size, the Indian art market is only about 0.1% of the international market. So, the potential for growth is huge.”

In the mid-90s’ Indian art auctions were held in London and New York. Slowly but steadily, art is enlarging its canvas in India, with new galleries being set up in Bangalore and other cities. “Art was viewed as a status symbol. But post 2000, it has emerged as an investment option. Now, it is being considered as a separate asset class,” said Anu Bajaj, chief executive officer, BCAH.

The Indian art market is today valued at about Rs 1,500 crore growing at 30-35% annually. But what are the pitfalls? “The art market here is not regulated. Though Sebi and the government have taken some steps to improve efficiencies like introducing ban on collective investment schemes in art works, the market needs to mature like equity markets,” said Mehrotra.

“We don’t see any big risks yet but yes there are concerns like liquidity, transparency mechanisms, fake art works.”

mardi 7 octobre 2008

Pop Goes the Bubble in Chinese & Indian Art

Fallout from the global economic crisis hits the opening sale of modern and contemporary Asian art at Sotheby's in Hong Kong. Source BusinessWeek

While much of Hong Kong hunkered down just hours before the arrival of a typhoon on Oct. 4, the start of Sotheby's three-day auction of modern and contemporary Asian art was buffeted by the financial storm on Wall Street. Of the 47 works that went under the hammer, more than 40% were unsold. What's more, earnings for Sotheby's (BID), including the auctioneer's commission known as the "buyer's premium," were a paltry $15 million, accounting for just 41% of the auction house's estimated takings for the night. Among the biggest upsets was the unsold work by India's hot-selling artist Subodh Gupta, Untitled, which had an estimated price of $1.55 million to $2.05 million. Another big surprise: Chinese cynical realist painter Liu Wei's triptych, The Revolutionary Family Series, failed to find a bidder willing to meet the $1.55 million suggested minimum.

As the weather deteriorated on Sunday morning, so did events in the auction hall. Only 39 out of 110 paintings from the 20th Century Chinese Art Sale found buyers, while 71 had to be packed up and shipped back to their sellers. By the afternoon session, the usual buzz at Hong Kong's contemporary Chinese art auctions was sorely absent. At one point during the sale, the auctioneer mistook a woman covering her mouth to stifle a yawn for her wishing to bid, prompting a valiant attempt to inject some levity into the proceedings as he asked if "anyone else is yawning in the room."

Yawns gave way to disbelief a little later when two works by white-hot Chinese artist Zhang Xiaogang went unsold. That's a huge reversal for the Beijing-based artist, whose paintings have routinely fetched millions of dollars, well in excess of auction estimates. (His painting Bloodline: Big Family No. 1 was one of the few top lots that sold on Saturday, though the $2.97 million price was below the expected maximum.) Yue Minjun and Zeng Fanzhi, two others among the hottest-selling Chinese contemporary artists, did manage to sell, although well within the estimates.

Wall Street Fallout

You connect the dots: Wall Street goes into meltdown, and Sotheby's auction bombs in Hong Kong. Kevin Ching, Sotheby's CEO for Asia, tries to be optimistic about whether the two are connected. "I hope there is no immediate direct correlation between the financial market and the art market," he says, pointing to the widely successful auction of enfant terrible Damien Hirst's works in London within days of the collapse of Lehman Brothers. The problem with some of the Hong Kong auction, he adds, stems from overly ambitious owners trying for unreasonably high prices. "When we have [sellers] who want aggressive estimates over and above what [the] market can accept, they would have to occasionally accept the consequences, and I think that's what happened here [Saturday] night," Ching explains.

Still, others in Asia's art business are certain the fallout from Wall Street is already hurting Chinese and Indian markets. In both countries, newly wealthy investment bankers and hedge fund managers helped inflate bubbles (BusinessWeek, 6/5/06) in works by local artists. For instance, in the last four years a booming Indian economy (BusinessWeek, 6/5/06) and buoyant stock market encouraged many private banks to offer fee-based services to assist clients in building portfolios of artworks sourced from galleries, auctions, and even direct sales. Fund managers say that investment bankers with their hefty bonuses helped inflate art prices by 30% to 60% above their real value, according to a gallery owner in Mumbai.

Bright Spots

Now with Wall Street in turmoil, most of the bankers who were regulars at art shows and auctions have moved out, says avid art collector Harsh Goenka, chairman of India's diversified RPG Enterprises, which has interests in tires, power, and retail. He claims that in the last few years, around 60% to 70% of art sold in auctions and shows in India went to the new breed of investor rather than art connoisseurs. "They looked at art as a brand and made money by trading in it," says Goenka. In the past few months, he says, painters and art dealers have been calling him up to offer their unsold works at a 30% to 40% discount.

The picture isn't all grim, though. The mood was positively ebullient at Sotheby's Hong Kong on Oct. 6 as buyers crammed the room for the auction of Southeast Asian contemporary paintings. Sotheby's employees manned the phones to handle enthusiastic overseas bidding. For instance, Indonesian painter I Nyoman Masriadi had already set a personal record on the first day of the Sotheby's auction when his huge canvas featuring Batman and Superman sitting on adjacent toilets sold for $620,000. He then surpassed that with a painting of boxers that seems part Botero, part Léger; it fetched a high $833,000. A bit later, during furious bidding for yet another Masriadi, the auctioneer exclaimed "This is really, really fun." The room broke into applause when the work finally sold for a very respectable $307,000.

The reason for this sea change in sentiment? The prices were far more affordable than the works from China and India on sale during the weekend, and collectors seem to have finally cottoned onto the notion that Indonesian, Vietnamese, and Filipino artists represent opportunities for collectors to own great art. One work by up-and-coming Filipino painter Geraldine Javier sold for $32,000, more than three times the high estimate. An intimate portrait of a woman and child by Vietnamese painter Mai Trung Thu also sold for triple the estimate, fetching $23,000.

mardi 23 septembre 2008

FEATURE-Indian art offers high appreciation in volatile climate

Source Forbes.com NEW DELHI, Sept 23 (Reuters) - Indian art might be just the solution for investors seeking a safe haven at a turbulent time.

Take a vivid landscape by avant-garde artist Francis Newton Souza hanging on a wall in Indian art dealer Ashish Abnand's New Delhi gallery. With a price tag of $400,000, the painting might not seem like a bargain but Abnand says it will probably be worth $2 million within the next two years.

Art dealers and experts say the Indian art market is still undervalued and there is money to be made in local art for those with the means to pay the six figure prices that works by some of India's leading artists fetch at auctions.

"I think Indian art is a one-way bet in the long term. That's why I will allocate money to it," said Philip Hoffman who runs the Fine Art Fund based in London.

"If you look 50 years down the line, what you pay now is peanuts compared to what you will have to pay for the great Indian artists," he told Reuters at an Indian art summit in New Delhi in August.

The prices of Indian art have gone up considerably but not at the levels of Chinese art, which has seen prices soar due to enormous interest at home and abroad. Dealers believe Indian works have plenty of room to appreciate, especially as South Asian art begins to draw a Western audience.

"The growth potential is huge," said Hugo Weihe, Christie's international director of Asian Art.

"The Indian art market is particularly strong within India and that's different from the Chinese contemporary. You have that component plus we are now reaching out to an international component every season."

Often depicting vivid and colourful scenes of Indian life and culture, Indian art has long been popular among wealthy Indians, whose ranks are growing rapidly in a booming economy. Yet until recently Western collectors had not taken much interest in classical and contemporary Indian artists.

That is starting to change. Weihe predicts that sales of Indian art at Christie's auctions might reach $30 million this year, compared with $680,000 in 2000.

SKYROCKETING VALUATIONS

Asia's art scene has blossomed in the past five years driven by the continent's rapid economic growth. Valuations have skyrocketed as Asian art has become an investment for speculators and a symbol of affluence for a growing pool of local collectors.

The record for a contemporary Indian art work was set in June when Francis Newton Souza's piece 'Birth' was sold for $1.3 million pounds ($2.3 million).

The figure was, nevertheless, significantly lower than the $9.7 million record price for Chinese artist Zeng Fanzhi's piece 'Mask Series 1996 No. 6' sold at an auction in Hong Kong in May.

Works by famous Indian artists such as Maqbool Fida Husain and Syed Haider Raza currently go under the hammer for anywhere from $200,000 to $1 million.

Yet industry players expect prices to shoot up to between $5 million to $10 million in the next few years.

Neville Tuli, a manager of a $400 million art fund in India, believes that Indian art will appreciate by between 18 to 25 percent per year in a climate in which art is increasingly seen as a secure investment.

"Financial institutions and their HNIs (high net worth individuals) are recognising the inherent stability in the art object as a capital asset," said Neville Tuli, a manager of a $400 million art fund in India.

"Hence given its low correlation to economic circumstances and other related factors, the proportion of art within the alternative asset allocation is increasing significantly," he added.

HOT MONEY CANVASES ART

But as with all investments, there are risks. The Indian market is vastly different from the Western art markets because in India, art is viewed more as a financial investment rather than a collectors item, art fund managers said.

"It has gone up 200 times in five years," said Hoffman, of the London-based Fine Art Fund, adding that the Indian market consisted of 70 percent speculators and 30 percent collectors.

This trend of rapid buying and selling, makes it difficult to predict long term value. "Let's say you've got a Gupta," Hoffman said, referring to Subodh Gupta, one of India's hot new artists whose pieces sell for between $800,000 to $1 million. "It's a financial commodity like a stock," Hoffman said.

"You need the Bill Gates of this world to say I want a Gupta and I don't give a damn how much it cost. It's going into my collection and it's not for sale," he added, saying a growing pool of collectors will give the market stability. Art experts would like to see more people like Kusam Sani, a wealthy fashion consultant based in Delhi, who is one of the few art collectors who keeps the art they buy.

"I have a 40 foot dining room and it's covered with work, but I can't buy anymore because I've got no more space," said Sani, who has been collecting paintings since she was a teenager.

Greater government investment in art infrastructure and museums will give the market stability in the long term, experts said, although they noted that so far the Indian government has shown little political will to support such projects.

There are also bureaucratic hurdles such as permits to export works of art and requirements to register antiques with government bodies that turn acquisitions of Indian art into a headache for dealers and collectors abroad.

But despite the market's shortcomings, art dealers, Weihe and Hoffman are bullish on Indian art.

"The Indian market will mature when the real collector base is grown up and put the money is put to one side," Hoffman said.

"In the long run, all these artists are going to be global, they just happen to be local at the moment."

lundi 22 septembre 2008

Art Market Watch

Source artnet.com Sept. 22, 2008

The contemporary art market is not, as one might have thought last week, all about Damien Hirst. Several other contemporary auctions took place in New York in September 2008. A brief report follows.

Christie’s "First Open" sale in its Rockefeller Center salesroom featured 229 lots, of which 169 found buyers, or 74 percent, for a total of $6,507,800, just at the presale low estimate $6 million. The top lot, Cindy Sherman’s Untitled Film Still #13 (1978), a black-and-white photo of a buxom blonde reaching for a library book, sold for $902,500, almost double its presale high estimate of $500,000. Among the top ten, works by Jeff Koons and Robert Cottingham surpassed their high estimates.

Several other works soared above their presale estimates, including a largish (19 x 21 in.) drawing of Jackie Robinson from 1991 by Raymond Pettibon that sold for $37,500 (est. $12,000-$18,000). How did our picks do [see Art Market Watch, Sept. 9, 2008]? Well, Richard Prince’s cast flip flops, modestly estimated at $25,000 or more, failed to sell, as did Andy Warhol’s model for his BMW Art Car, at $250,000-$350,000.

But Tony Feher’s sculpture of four jars with red tops sold for $18,750, rather more than the presale high estimate of $6,000, and Sharon Core’s 2003 color photograph of a coconut cake surrounded by eight cake slices -- an homage to a similar painting by Wayne Thiebaud -- went for $15,000, almost three times the presale high estimate of $6,000. The sale represented a debut at auction for Core, and is of course a new auction record for her work.

Sotheby’s New York’s "midseason" sale of contemporary art on Sept. 10, 2008, which carried a overall presale estimate of $9.8 million-$14 million, totaled $10,556,939, with 285 of 412 lots finding buyers, or just over 69 percent. Works by Roy Lichtenstein, Robert Indiana, Adolph Gottlieb and Josef Albers were top sellers. Paintings by members of the Bay Area Figurative movement also did well, with Elmer Bischoff’s Rooftops and Bay (1961) going for $134,500, above its presale high estimate of $120,000, and David Park’s small watercolor Four Nudes from 1960 going for $104,000, more than triple the presale low estimate of $30,000.

Good prices were also paid for works by Chantal Joffe, whose ten-foot-tall Long Haired Brunette with White Wallpaper sold for $68,500, more than double the presale high estimate of $30,000, and a 1994 mixed media painting by Ouattara Watts, Gindo Voodoo, sold for $34,375, over a presale estimate of $6,000-$8,000. Both prices are new auction records for the artists.

What’s more, Christie’s held its first contemporary design sale on Sept. 8, 2008, a relatively low-key event that totaled $1,161,500, with 21 of 30 lots finding buyers, or 70 percent. The overall presale estimate was $1.2 million-$1.7 million. Christie’s specialist Carina Villinger called the results "promising" and noted "enthusiastic global interest indicating a sold and evolving contemporary design market."

Most of the top prices came in at the lower end of their presale estimates, though the sums were substantial all the same. A Ron Arad mirror-polished, stainless steel D sofa designed in 1995 went for $206,500 (est. $200,000-$300,000), while a Shiro Kuramata acrylic and aluminum stool with feathers designed in 1990 sold for $86,500 (est. $80,000-$100,000).

Then there were the Asian Art Week sales, during the third week in September, a bit overshadowed by Hirst-mania, not to mention the Wall Street turmoil. With both Chinese and Indian contemporary art, top-level buyers are increasingly native, rather than from the U.S. or Europe. This market dynamic is reflected by the decision of both houses to move their Asian contemporary sales to Hong Kong, where they are initiating evening sales of Asian art in October. Christie’s skipped holding a sale of contemporary Asian art in New York this week, and the sale at Sotheby’s on Sept. 17, 2008, was the last such dedicated sale in the city, at least for the time being.

Still, Christie’s New York held eight separate sales for Asia week, Sept. 15-18, 2008, totaling $51.1 million overall, which the firm called its second-highest total for the category of sales in New York. Christie’s South Asian modern and contemporary art sale on Sept. 16, 2008, totaled $12,634,375, with 84 of 126 lots selling, or 67 percent.

The artist Subodh Gupta (b. 1964), who makes both paintings and sculpture, is the shining light of the Indian contemporary market, with a Pop consumerist esthetic that has been compared to that of Jeff Koons, as well as a recent auction record, set in June 2008, of $1.18 million. At Christie’s, his works took three of the four top spots. Steal 2 (2007), a 66 x 90 in. oil on canvas reproducing a detail of one of his famous accumulation sculptures of stainless steel cooking utensils, sold for $1,166,500, just above the presale high estimate of $1,000,000

Gupta’s Miter (2007), an actual collection of such utensils -- installed in a corner in the shape of a Valentine’s Day heart -- sold for $1,022,500; it is one of an edition of three. The third Gupta work was an untitled 2005 painting from his migration series, showing luggage on a wheeled cart at an airport. It sold for $962,500 (est. $600,000-$800,000).

As for Sotheby’s, its New York series of four Asian art sales, Sept. 16-19, 2008, totaled $26,008,097 overall, falling just short of the presale low estimate of $27.9 million. The sale of Asian contemporary art from China, Korea and Japan on Sept. 17, 2008, totaled $8,513,288, with 137 of 211 lots selling, or almost 65 percent.

Of the top nine lots, seven were snapped up by Asian buyers, according to Sotheby’s. The top lot was a relatively small (39 x 32 in.) 1997 work from Zeng Fanzhi’s Mask Series, an auction-room favorite, here showing a suavely suited Chinese businessman with a Boston terrier on a beach, that went for $1,082,500 (est. $900,000-$1,200,000). The artist, whose auction record is $9.7 million, is having a show at Acquavella Galleries in New York this fall.

Soaring past their presale estimates were a 1957 Braque-inspired work by Kim Whanki, Flying Birds ($434,500) and a version of Zhang Huan’s emblematic suite of nine photographic self-portraits with his face progressively obscured by Chinese brush calligraphy, Family Tree ($386,500), a new high for a work from this series.

Other top prices were brought for an exploded gunpowder drawing of two eagles by Cai Guo-Qiang ($422,500), a storybook-style painting of a boy with a giant red fish by Liu Ye ($362,000), a Socialist Realist satire by Wang Guangyi ($314,500), and a hyper-keyed image of a glamour girl by Feng Zhengjie ($242,500).

Sotheby’s sale of modern and contemporary art from India and Pakistan the following day, Sept. 18, 2008, totaled $7,845,500, with 82 of 126 lots selling, or just over 55 percent. Once again Subodh Gupta was the contemporary star, with his One Cow (2003), a 66 x 90 in. painting of a bicycle with several milk pails, selling for $866,500, just above the presale high estimate of $800,000.

Another high-priced contemporary lot included Thukral and Tagra’s "superflat"-styled Metropolis 1 dyptich from 2007, which sold for $182,500. The work was originally purchased by the seller in the same year it was made from Nature Morte in New Delhi. The artist’s action record, set in 2007 in Hong Kong, is $463,474.

For complete, illustrated results, see Artnet’s signature Fine Art Auctions Report.

dimanche 21 septembre 2008

Where Is Indian Contemporary Art Today And Where Do We Go Next

By Peter Osborne. Source : indianartnews.com It is five years since I first started to collect and deal in Indian art and now is perhaps a suitable time to reflect on the state of the market as the Indian art boom moves on to its next phase.

First the good news. Indian contemporary art is in a great place, with many talented and provocative artists producing challenging, innovative artworks that are attracting attention from collectors around the world. Galleries and auction houses in Europe, USA, the Middle East, Hong Kong and elsewhere have generated huge interest in and demand for Indian art. The continuing growth of the Indian economy will feed through into the levels of personal wealth and cultural aspiration amongst Indians and NRIs that typically benefit the art market. It is a young market but maturing fast. Despite the global debt crisis and subsequent market turmoil art still seems to be attractive to buyers with recent strong auctions in India, London and New York.

Five years ago my Indian contacts gave me a list of the top ten artists that made up the “A List” and another 10 less important names who made up the “B List”. All the first ten were Modern Masters and only Gupta and a couple of other younger artists crept into the second group. I was flatly told that no one else mattered.

So we have come a long way since then, and any number of rising stars are selling for six figure dollar sums. There are literally hundreds of gallery shows and Indian art is starting to take its place on the international stage.

Auction houses in India and elsewhere are in a feeding frenzy and new artists are becoming established almost overnight with an insatiable competition to drive up prices and meet demand. The many funds investing in Indian art do not help to create market stability with aggressive, selective purchasing and erratic selling on a large scale. The comparative short term illiquidity of the art market is something that many collectors appear not to understand.

The Indian market has temporarily shifted in emphasis away from the Modern Masters towards younger contemporary artists. This is a global trend as new collectors seek out what is fashionable and ‘edgy’ and perhaps consider the Moderns as backward looking and a little dated. In the Indian context I don’t accept this, I reckon the trend has a lot more to do with investment returns, which used to be considerable for the Moderns but no longer are, whereas a fortuitous speculation in a young artist can generate a substantial short term return for the investor. So the gambler has simply moved to another table where the stakes are lower and the potential returns are higher.

Ultimately Contemporaries become Masters, but only very few go all the way and become permanently established. The rest stagnate and then fall back, sometimes quite quickly. This will happen to certain Indian contemporary artists from now on, especially those who do not have watertight, long term contracts with respected galleries inside and outside India, and ideally an international buyer base.

A huge amount of money is pouring into Indian art and it is no surprise that some of it is not being spent wisely. And as more and more artists ‘come of age’ so more and more will be discarded, and in my 25 odd years in this business one thing is for sure, the sharper the climb, the steeper the fall. True collectors are only interested in the visual and aesthetic qualities of their acquisition, price and investment value are very secondary. I sense that there are not yet too many genuine collectors in India and that the investor/speculator predominates. This is dangerous and likely to lead to tears and recriminations as buyers try to recycle their pictures and find that they have lost 50 or 75% of their value in a relatively short space of time.

Remember the auction house may be a market maker and may appear to underpin irrationally high price levels. But ultimately the auction house is an agent and will be happy to take a percentage at whatever price the artwork achieves, be it double or half the current level.

This state of affairs doesn’t just apply to Indian art. All the contemporary art markets are characterized by this trend. Very wealthy buyers might not care and will write off their purchases to indulgence. The Damien Hirst phenomenon is a perfect example of this. Everyone wants a piece of Hirst, and demand is almost limitless, regardless of any price/value ratio. The auction houses are brilliant at providing a buzz and excitement for purchasers who may regret their acquisitions in the cold light of day. In today’s world packaging and marketing are paramount.

So what would I like to see happen to Indian art.

I would like to see more good shows outside India.

I would like to see less decorative pictures with wishy-washy political messages and more edgy, controversial art works in more experimental media.

I would like to see more photography.

I would like to see more sculpture BUT properly cast and patinated. Cheap metal alloys do not look good and do not last.

I would like to see good original prints made by artists, small edition etchings and lithographs, NOT cheap reproductions of paintings.

I would like to see more non Indian art in India, which is now one of the world’s biggest art markets but virtually no museum or art gallery shows non Indian art.

I would like to see Indian art museums amount to something. Right now they don’t really count. All around the world visitors and connoisseurs head for the art museums to understand what is happening and to study historic trends. The Indian government should of course encourage donations with tax advantages but I somehow doubt this will happen in the short term.

I would like to see more attention being paid to pre-Independence Indian art. To paraphrase, to enjoy the shoots you need to understand the roots.

mardi 16 septembre 2008

L´Inde, le nouvel Himalaya du marché ?

Source : Art Market Insight [sept. 08]

Cette semaine, à New York sont orchestrés de nombreuses ventes thématiques dédiées au marché asiatique, devenu en moins de trois ans l´un des secteurs les plus porteurs.

Avec la Chine, l´Inde est l´autre prétendant à la direction du marché de l´art international. Au milieu des années 90, la forte croissance indienne fait émerger une nouvelle génération de mécènes prêts à investir dans l´art de leurs concitoyens. Aujourd´hui, la demande est mondiale et grandissante, portée par un climat très spéculatif aux possibilités d´allers retour alléchants. Les nouvelles étoiles de l´art indien sont disputées à Hong-Kong et Dubaï, Londres et New-York, New Delhi et Paris. Après la Chine, l´Inde apparaît comme un nouvel Eldorado pour les collectionneurs attirés par la spéculation.

Le sculpteur Anish KAPOOR, est une parfaite illustration de cette flambée des prix. Introduit pour la première fois sur le second marché dans les années 1980´ pour 15 400 €, l´artiste a vu sa cote prendre deux zéro de plus ces quatre dernières années, notamment par le biais de ses grandes sculptures en albâtre. Mesurant près de 2 mètres de haut, celle dispersée le 1er juillet 2008 à Londres est partie pour 1,72 m£ (2,2 m€). Désormais, certaines de ses sculptures miroir atteignent de tels niveaux de prix, à l´instar de Blood Mirror, un disque de 2 mètres adjugé 520 000 £ (789 000 €) en février 2007. La cote de Kapoor ne cesse de progresser depuis 2004, même sur les multiples. Par exemple, Blood Solid, un bronze laqué rouge tiré à 8 exemplaires, a été adjugé une première fois 80 000 $ en 2004. La version proposée deux ans plus tard chez Sotheby´s a trouvé acquéreur pour 92 000 £ (136 000 €) et celle dispersée cette année a atteint 250 000 $ chez le même auctioneer à New-York (162 000 €).

Autre élu de la scène artistique indienne, Subodh GUPTA âgé de 44 ans, était inconnu des salles des ventes internationales quatre ans plus tôt. Aujourd´hui, il est considéré comme le Damien Hirst indien en regard de sa notoriété, et ses prix flambent! En 2005, Sotheby´s dispersait sa toile Fisherman pour 13 000 $ (10 700 €). C´est à cette époque que le marchand Pierre Huber l´exposa sur son stand à la Frieze Art Fair. En 2007, les prix de ses toiles avaient largement décuplé pour s´échanger entre 130 000 et 280 000 € en moyenne ! Son succès est mondial : prisé à Hong Kong, Londres ou New York, il l´est aussi en France.

Les grandes maisons de ventes, Christie´s et Sotheby´s en tête, soutiennent le marché à un rythme de plus en plus soutenu en multipliant les ventes spécialisées. En France, le premier chapitre dédié à l´art moderne et contemporain Indien fut écrit par Artcurial le 3 décembre 2007, lors d´une vacation d´art chinois et indien. Il trouvait un écho favorable (1,4 million d´euros de produit de ventes) avec quelques succès notables, dont celui du jeune Manjunath KAMATH (1972). Son acrylique intitulée Teeth Politics (2007) achevée peu avant sa mise à l´encan, partait pour 36 000 €. Poursuivant sur sa lancée, Artcurial incluait de l´art indien dans sa vente d´art contemporain du 3 avril 2008 et déclassait le précédent sommet de Sudodh Gupta ! L´installation Vehicle for the seven Seas de Gupta obtenait en effet 425 000 €, plus de trois fois l´estimation… une enchère record portée par un collectionneur français ! Succès de courte durée, puisqu´un mois plus tard, à Hong Kong, Saat samundar paar (10), est partie pour 8 mHKD (651 000 €) et au 1er juillet 2008 une toile de 2005 s´est envolée pour 520 000 £ (657 000 €) à Londres chez Sotheby´s.

L´une des grosses surprises de l´année 2007 est le jeune Raqib SHAW, dont Garden of earthly Delights III s´est totalement envolé à hauteur de 2,4 m£ (3,45 m€) à Londres le 12 octobre, établissant un record pour une œuvre d´art contemporain indien. Il faut dire que cette pièce majeure avait un bon pedigree. Acquise à la Victoria Miro Gallery en 2004 elle avait été exposée au MoMA (NY) en 2006.

D´autres artistes indiens sont en train de prendre d´assaut les premières places dans le classement des artistes actuels les plus cotés. Le 20 septembre 2007, le peintre Atul DODIYA a décroché une enchère de 450 000 $ (322 000 €) pour Three Painters. Introduit depuis 2006 aux enchères, Bharti KHER a vu, en avril 2008, l´un de ses paysages s´arracher 165 000 £ (209 000 €) à Londres, pour une estimation de 40 000 – 60 000 £. Un mois plus tôt, un diptyque de TV SANTOSH est partit pour 280 000 $ (178 000 €) chez Christie´s New York. Parmi les autres résultats à 6 chiffres enregistrés, signalons encore celui de Shibu NATESAN pour l´équivalent de 113 000 € et de Jitish KALLAT, 105 000 €, décrochés en mai dernier à Hong Kong.

Dopée par des ventes spécialisées, la cote de l´art contemporain indien affiche une progression impressionnante : en juillet 2008, on enregistrait un indice des prix en hausse de +3 230% sur la décennie !

dimanche 14 septembre 2008

New Delhi, nouvelle capitale de l'art

Source : Les Echos New Delhi est devenu une capitale de l'art au même titre que Londres, New York ou Paris. La preuve ? L'un des artistes vivants le plus cher au monde y expose ses créations. « Sotheby's va exposer une sélection d'oeuvres du fameux artiste et sculpteur Damien Hirst à l'hôtel Oberoi de Delhi avant une vente aux enchères », qui aura lieu mi-septembre à Londres, explique le quotidien « The Times of India ». Pour Sotheby's, le choix de l'Inde s'est imposé assez naturellement à cause de la mondialisation du marché de l'art. En 2003, les gros clients de Sotheby's venaient de 36 pays différents. Aujourd'hui, 58 nationalités constituent la clientèle privilégiée de la maison britannique. Et parmi ses nouveaux collectionneurs, le nombre d'acheteurs indiens lors des enchères a doublé entre 2004 et 2007.

Oliver Barker, un spécialiste de l'art contemporain de Sotheby's, a déclaré que cette expérience servirait d'enseignement pour la société de vente aux enchères, expliquant que cette passion soudaine pour l'art contemporain en Inde était en partie due au succès d'artistes locaux tels que Raqib Shaw ou Subodh Gupta. Le quotidien indien rapporte ainsi qu'une « oeuvre de Shaw, «Le Jardin des délices III», s'est vendue pour 3,3 millions d'euros en octobre dernier, un record pour une oeuvre indienne lors d'une vente aux enchères ». Barker estime également que cette exposition est « par de nombreux aspects, la plus importante en Inde pour un artiste étranger ». Toutefois, selon Sotheby's, les collectionneurs indiens sont encore dans une phase de découverte de l'art occidental. Ainsi, les quatorze oeuvres de Hirst qui sont exposées ont été choisies parmi plus de 200 créations pour être susceptibles de plaire à un public local. Pas question, donc, de trouver les cadavres d'animaux conservés dans du formol que Hirst expose dans des aquariums dans le cadre de sa réflexion sur la vie et la mort. Non ! il s'agira plutôt de ses peintures avec des papillons naturalisés, de ses toiles faites de points de couleur et de ses sculptures agrémentées de diamants.

samedi 6 septembre 2008

vendredi 5 septembre 2008

The Success Story of India's First International Art Fair

Source : Gather.com

The recent Art Summit was the Indian art scene’s attempt to climb a new rung in its international aspirations, says NISHA SUSAN

An astounding 10,000 art enthusiasts walked in to witness India’s First International Art Fair, India Art Summit(TM) 2008, firmly establishing it as a one stop destination for art in India. With an overwhelming mix of art collectors, artists, critics, curators, students and art enthusiasts from across India and overseas, the Summit achieved exactly what it set out to - making art, and the knowledge of art, accessible to a widespread audience.

Commercially speaking, the fair clocked in a record sale of approximately 50%, with the 34 participating galleries selling over 280 artworks worth Rs.10 crores approximately. Given that the total value of the 550 artworks on display was approximately Rs. 20 crores, India Art Summit has emerged as one of the most successful first editions of any art fair across the world.

With all eyes now on India, event producers Hanmer MS&L, have announced plans to schedule India Art Summit 2009 between 19th - 22nd August’ 2009 in New Delhi. Next year, the fair is proposed to be over three times bigger and applications are already pouring in from across India and world. While in the first year, the focus was largely on Indian art and Indian galleries, the second year will see participation from galleries across the world showcasing a sizeable array of artworks from different parts of the world.

Ashok Art Gallery is a five-yearold Delhi gallery that largely functions online. A mom-and-pop operation with a handful of unknown artists, Ashok Art Gallery has never had any exposure in the media. Their only previous art fair experience was with the Mumbai art expo earlier this year. As one among 35 galleries that participated in the recent India Art Summit (between August 22 and 25), Ashok Art Gallery did not expect to become frontpage news. But their 27-year-old Oriya artist Kanta Kishore’s marble sculptures of rolled-up newspapers were sold within hours of the fair’s opening. Gallerists Ashok Nayak and Kavita Vig, Kavita’s husband Bharat and septuagenarian mother-in-law watched astonished as the art young Indian superstar Subodh Gupta and politician Maneka Gandhi came to their stall. And in their wake, thousands of visitors and the press.Sculptures and installations sold almost as well as paintings, signalling a new trend. The panel of speakers and choice of topics at the Art Forum also drew many accolades and was deemed as amongst one of the best such initiatives of its kind, internationally.

Mr. Sunil Gautam, Managing Director, Hanmer MS&L commenting on the fair said, “It is great to see that India Art Summit has emerged as the most inclusive collaborative art platform in India in it’s very first year. We believe that this initiative is a step in the right direction to put India on the global art fair circuit.”

Commenting on the success of the fair, Mr. Philip Hoffman, Chief Executive, The Fine Art Fund said “The Indian market is very important in the global art scene and this fair is a major step. I can imagine this to be major fair in Asia competing alongside London, Miami and Basel in the next 5-10 years. The sales results of the fair seemed very impressive by comparison to other fairs in their first year.”

India Art Summit - Backgrounder

The art fraternity in India has for long felt a gap and the need for a collaborative industry platform in the country owing to the phenomenal growth and global interest in Indian art. While the art fraternity the world over gets numerous opportunities to interact and collaborate through various art fairs, biennales & expos, there was no such platform in India. Therefore the time was right for India to offer a suitable platform for art. The initiative has received invaluable recognition and endorsement from the Ministry of Culture, Government of India and Sotheby’s.

The Summit hopes to achieve the dual purpose of, on one hand, serving as a window for International collectors to get a single access point to Indian art and, on the other, exposing the Indian collectors to a range of global Art that will be showcased at the fair in the coming years. More than just a place for buying and selling art, this initiative will enable diverse stakeholders from India and around the world to come together and discuss the creative and commercial aspects of Indian art.

Today, Indian art is greatly appreciated both internationally and within the country, annually growing at 30-35%, the Indian art market is currently worth Rs 1500 crores. The Indian art market has gone up by 485 percent in the last decade making it the fourth most buoyant art market in the world. The total auction market size of Indian art has changed from US $5 million in 2003 - just five years back - to nearly US $150 million this year.

Saffronart auction: Indian art sets 18 world records

Source : ECONOMICTIMES.COM by Arunava Biswas

NEW DELHI: Saffronart closed its exciting Autumn Online Auction of Contemporary Indian art on Thursday, registering a total sale value of approximately Rs 29 crores ($7.2 million), about 72% in excess of the low estimate.

At the sale, world auction records were set for 18 Indian artists, including T V Santhosh, Anju Dodiya, Sudhir Patwardhan, G R Iranna, Mithu Sen, Anita Dube, Sudarshan Shetty, Anil Revri, Tushar Joag, Manisha Parekh, Debanjan Roy, Phaneendra Nath Chaturvedi, Kishor Shinde, Chitra Ganesh, Ravikumar Kashi, Ram Bali Chauhan, Mayyur Kailash Gupta and Nicola Durvasula.

The sale featured several genres of contemporary Indian art including painting, sculpture, photography and installation. Contemporary artists are increasingly gaining more strength in auctions. Together with Chinese and Southeast Asian art, Indian works of from this genre is witnessing tremendous growth.

While US contemporary art is leading the pack, this genre is sweeping the world and younger artists are establishing a connect with the recent global art trends.

Over 575 registered bidders from all over the world competed against each other for the works of some of India's most talented artists. The top five lots of this Saffronart auction were Subodh Gupta’s 'Idol Thief I', selling for Rs 4.28 crores ($1.07 million); Subodh Gupta's 'Saat Samundra Par' (Across the Seven Seas), selling for Rs 3.4 crores ($850,000); T V Santhosh's 'When your Target Cries for Mercy', selling for Rs 2.8 crores ($701,500); Anju Dodiya's 'The Site', selling for Rs 1.06 crores ($267,375); and Sudhir Patwardhan’s 'The Clearing', selling for Rs 93,15,000 ($232,875).

Within the first hours of the auction, several lots crossed their higher estimates, including T V Santhosh’s diptych, featured on the cover of the catalogue, and works by Subodh Gupta, Riyas Komu, Anandajit Ray, G R Iranna, Tushar Joag, Dhananjay Singh and George Martin, setting the pace for the exciting bidding activity that continued till the last seconds of the sale.

NRIs and domestic collectors are getting increasingly active at international auctions of Indian contemporary art. While old buyers are picking up pieces occasionally, there is a fair cross-section of newer collectors who have entered the field.

lundi 1 septembre 2008

Devi Art Foundation Opens New Exhibition Space in India

Source : Artdaily.org GURGAON.- The Devi Art Foundation is one of the first not-for-profit spaces dedicated to showcasing contemporary art from the Indian Subcontinent. It has been established to facilitate the viewership of creative expression and artistic practice that exist in the region. It is envisioned as a space that will enable wider audiences to interact with cutting edge and experimental art works.

Devi Art Foundation's inaugural exhibition is entitled 'Still Moving Image'. 'Still Moving Image' is the first in a series of upcoming exhibitions, curated out of the Lekha Poddar and Anupam Poddar collection. It shows a selection of video and photography compositions by 25 Indian artists namely Aastha Chauhan, Atul Bhalla, Avinash Veeraghavan, Baptist Coelho, Bharti Kher, Kiran Subbaiah, Mithu Sen, Nalini Malani, Navin Thomas, Pushpamala N., Ram Rahman, Rameshwar Broota, Ranbir Kaleka, Ravi Agarwal, Sheba Chhachhi, Shilpa Gupta, Sonia Khurana, Sudarshan Shetty, Surekha, Susanta Mandal, Tejal Shah, Tushar Joag, Valay Shende, Varsha Nair and Vivan Sundaram.